The first test a company should apply to determine if it qualifies for the Employment Retention Credit (ERC) is the gross receipts test. It is the first test because it is a safe harbor test, meaning that if a company passes it, the Internal Revenue Service (IRS) will not question the company’s eligibility for the credit. This test is much simpler than trying to tie a measurement to a government order related to COVID-19.

I discussed eligibility for the Employee Retention Credit (ERC) in detail in a previous article “What Businesses are Eligible for the Employee Retention Credit (ERC).”

This article contains a deeper discussion of the gross receipts test as well as a step-by-step analysis to determine the calculation.

Note these steps need to be followed on a quarter-by-quarter basis to verify eligibility each quarter. In other words, each quarter stands on its own.

Step One

The first step is determining what is considered to be gross receipts. This is answered in Notice 2021-20, question #24, where the IRS states:

Question 24: What are “gross receipts” for an employer other than a tax-exempt organization?

Answer 24: “Gross receipts” for purposes of the employee retention credit, for an employer other than a tax-exempt organization, has the same meaning as when used under section 448(c) of the Code. Under the section 448(c) regulations, “gross receipts” means gross receipts of the taxable year and generally includes total sales (net of returns and allowances) and all amounts received for services. In addition, gross receipts include any income from investments, and from incidental or outside sources. For example, gross receipts include interest (including original issue discount and tax-exempt interest within the meaning of section 103 of the Code), dividends, rents, royalties, and annuities, regardless of whether those amounts are derived in the ordinary course of the taxpayer’s trade or business. Gross receipts are generally not reduced by cost of goods sold but are generally reduced by the taxpayer’s adjusted basis in certain property used in a trade or business or capital assets sold. Gross receipts do not include the repayment of a loan, or amounts received with respect to sales tax if the tax is legally imposed on the purchaser of the good or service, and the taxpayer merely collects and remits the sales tax to the taxing authority.

For most companies, gross receipts include:

- Total sales (net of returns and allowances)

- All amounts received for services

- Income from investments

- Income from incidental or outside sources

- Interest

- Dividends

- Rents

- Royalties

- Annuities

It is important to note that the amounts listed above are considered gross receipts for the Employee Retention Credit (ERC) even if those amounts are not included in the ordinary course of the taxpayer’s trade or business. A company needs to look closely at the affiliation rules when determining gross receipts. Determining gross receipts is not done on a company-by-company basis. All groups need to be included in this analysis. We have discussed the affiliation rules in detail in the article “ Employee Retention Credit and the Affiliation Rules.”

Step Two

The second step is to determine gross receipts on a quarter-by-quarter basis for 2019. For the Employee Retention Credit (ERC), the year 2019 is going to be the benchmark for all of the tests. This makes sense since during 2019 there was no pandemic nor government restrictions. Note that many companies will fail this test because they have expanded from 2019 to the current time. Companies that fail this test should view the article “Employee Retention Credit and the Partial Suspension Rules.”

Step Three

The third step is to determine gross receipts on a quarter-by-quarter basis for 2020. This is the year of maximum impact of COVID-19 and will be used for both Q-4 2020 and Q-1 2021.

Step Four

The fourth step is to determine gross receipts on a quarter-by-quarter basis for 2021.

Step Five

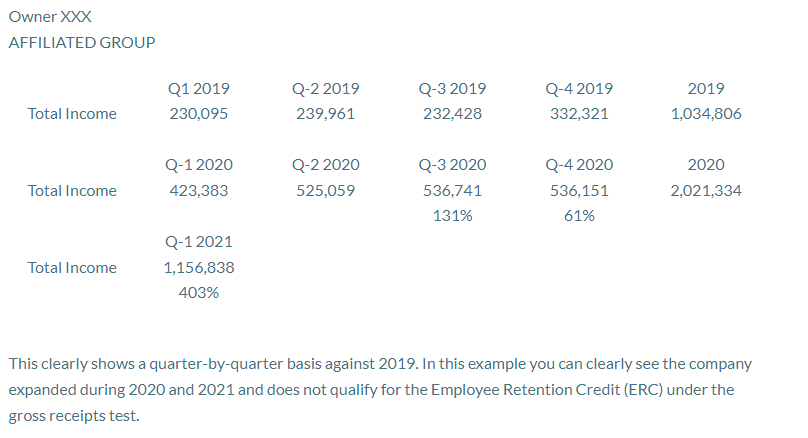

For the fifth step, We suggest creating a chart such as the one below:

Step Six

The sixth step is a direct test. A business qualifies for each quarter it passes this test.

- Q-4 2019 compared to Q-4 2020 – if revenue is down by 50%, a business qualifies for the Employee Retention Credit 2020.

- Q-1 2021 compared to Q-1 2019 – if revenue is down by 20%, a business qualifies for the Employee Retention Credit for 2021.

- A business will compare each quarter in 2021 to the same quarter in 2019. If the company’s gross receipts are down 20%, the business will have passed the gross receipts test.

Step Seven

The seventh step is an indirect test used to pass the reduction in gross receipts test. If a business passes the gross receipts test for the previous quarter, the current quarter gets grandfathered in.

Employee Retention Credit 2021

- For Q-1 2021, a taxpayer needs to show a 20% reduction in gross receipts in Q-1 2021 compared to the same quarter in 2019 (Q-1 2019), or a 20% reduction in gross receipts from the previous quarter Q-4 2020 compared to Q-4 of 2019.

- For Q-2 2021, a taxpayer needs to show a 20% reduction in gross receipts from Q-2 2021 compared to the same quarter in 2019 (Q-2 2019), or a 20% reduction in revenue from the previous quarter Q-1 2021 compared to Q-1 of 2019.

- For Q-3 2021, a taxpayer needs to show a 20% reduction in gross receipts Q-3 2021 compared to the same quarter in 2019 (Q-3 2019), or a 20% reduction in receipts from the previous quarter Q-2 2021 to Q-2 of 2019.

- For Q-4 2021, a taxpayer needs to show a 20% reduction in revenue from Q-4 2021 to the same quarter in 2019 (Q-4 2019), or a 20% reduction in revenue from the previous quarter Q-3 2021 to Q-3 of 2019.

Conclusion

As you can see, there are many ways to qualify for the Employee Retention Credit (ERC) using gross receipts. If your business fails the gross receipts test, I recommend you look at the article on partial suspension “Employee Retention Credit and Partial Suspension.”

If you have passed the gross receipts test, I recommend you read the article on how to calculate the Employee Retention Credit “Calculation of the Employee Retention Credit.”