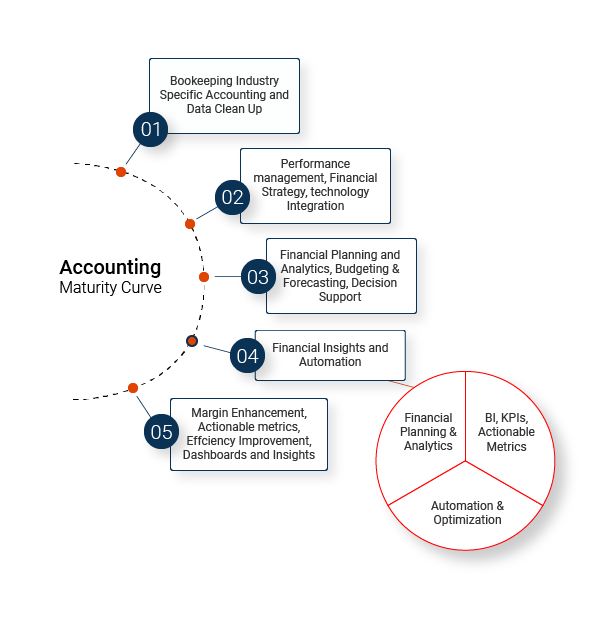

As businesses evolve, their financial management systems must do the same. The Accounting Maturity Curve represents a strategic path toward deeper financial intelligence and operational efficiency. Early stages involve foundational clean-up and performance management, setting the stage for more advanced financial planning and decision support. At the heart of this journey is the integration of financial insights and automation, where manual processes are replaced by intelligent systems that provide real-time data. This allows for more precise forecasting, agile decision-making, and a sharper focus on strategic goals. As organizations move further along the curve, they not only achieve financial transparency but also unlock powerful insights that drive growth, optimize margins, and ensure sustained success in a competitive landscape.

Financial tools and integrations can help streamline the process of gathering and analyzing financial data, making it easier for businesses to gain valuable insights. By integrating accounting software with data visualization tools, companies can generate real-time financial reports, track key performance indicators (KPIs), and forecast cash flow more accurately. This allows decision-makers to quickly assess the company’s financial health, spot trends, and make informed strategic decisions based on up-to-date data. Tools like QuickBooks, Xero, or Tableau can be used in combination to create customized dashboards that present financial information in an easily digestible format.